Manage your student budget during rising cost of living

18 November 2022

Its vital that you manage your student budget at university during this time of rising cost of living. UCL History student James Davis provides some tips for managing your finances .

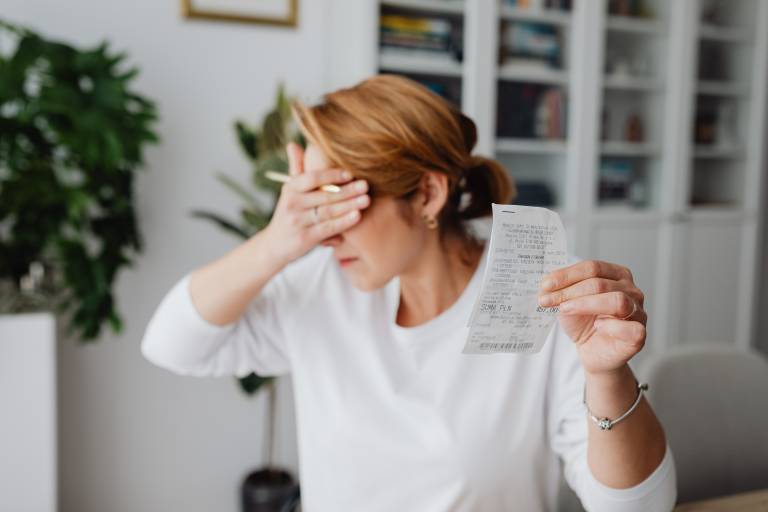

We are currently living through a cost-of-living crisis making funding student life harder than it was before. Rising inflation and sky-high energy bills mean that making ends meet can feel quite daunting now. But it doesn’t have to be. By adopting some savvy budgeting and cost-saving techniques you will be surprised how far you can stretch your finances or maintenance loan.

The Maintenance Loan

Everyone’s financial circumstances and lifestyles are different, this means that budgeting and priorities will vary from student-to-student. However, sound financial planning is relevant to everyone. A good way of making your student loan go further is by putting it into a savings account. By doing this you can pay yourself a weekly budget whilst earning a bit of interest. It is important that you stick to this budget and factor in what portion of it will be spent on food, utility bills and leisure activities.

Planning meals

The weekly food shop will take a large chunk of your student budget and can easily mount up if you lose track of spending. Make sure you only buy what you’ll use, check use-by dates and consider frozen options. This will reduce food waste and prevent you from overspending. It’s a wise idea to prepare meals at home. Buying ingredients to make your own lunch or dinner can save you a lot of money compared to eating out, ordering takeaways, or buying ready meals. Consider using apps such as Too Good to Go that lets you buy food at discounted rates from shops and cafés at the end of each day.

Student Discounts

Many shops offer a student discount. Using your student ID on you can help you bag a discount anywhere between 10-20%. Some shops may ask you to sign up to their loyalty card scheme to take advantage of the student discount, but you may be able to earn points and make additional savings. UNIDAYS can help you find these discounts so make sure you sign up and always check before you shop.

Subscriptions

At times like this it may be a good idea to check if you need all your subscriptions. Ask yourself if the service you’ve subscribed to is really value for money or are you making the most out of it. Do you need an expensive gym membership if you aren’t making the most out of it? Consider sharing subscriptions with friends or family or checking to see if a student discount is offered. For example, Spotify offers a student discount.

Bills

If you’re renting private accommodations, it is likely that you have or will notice an increase in your utility bills. Adopting some simple measures can help limit the amounts you’re paying. By submitting regular meter readings, you ensure that you only pay for what you use. And if your utility accounts are always in credit you can ask for a reduction to your direct debit. Don’t be afraid to haggle with service providers for things like Wi-Fi, you may be surprised how much you can reduce your bill by if you threaten to cancel or change suppliers. Otherwise, check out the Energy Saving Trust website to adopt some good habits to reduce your bills. For instance, taking shorter showers and turning lights off are small things that add up and can make a big difference over the course of a year.

Financial assistance from UCL

If you are struggling to make ends meet you must not be afraid to reach out for help.

UCL’s Financial Assistance Funds are there to help students in financial difficulty. If you’re in need, check to see if you meet the eligibility criteria. By reaching out for support if you need it and/or adopting some of these budgeting techniques should make getting through this cost-of-living crisis much easier. You can also check UCL’s new Cost of Living Hub.

How UCL Student Support and Wellbeing can help

If you need further support, make an appointment with one of our caring advisers, or, if you are living in UCL managed accommodations, speak to one of our friendly student residence advisers.

James Davis, UCL 3rd Year History Student

Close

Close