- Introduction

- 1. Introduction to Quantitative Analysis

- 2. Descriptive Statistics

- 3. T-test for Difference in Means and Hypothesis Testing

- 4. Bivariate linear regression models

- 5. Multiple linear regression models

- 6. Assumptions and Violations of Assumptions

- 7. Interactions

- 8. Panel Data, Time-Series Cross-Section Models

- 9. Binary models: Logit

- 10. Frequently Asked Questions

- 11. Optional Material

- 12. Datasets

- 13. R Resources

- 14. References

- Published with GitBook

5. Multiple linear regression models

5.2 Solutions

library(Zelig) # to predict from regression output and present uncertainty

library(texreg) # to plot regression output to screen or file

Warning: package 'texreg' was built under R version 3.2.3

Exercise 1

Clear your workspace and set your working directory to "N:/PUBLG100" if you work on a UCL computer or to your preferred computer if you work on your own computer.

Solution

# clear workspace

rm(list = ls() )

# set working directory

setwd("N:/PUBLG100")

Exercise 2

Load the data set corruption.csv http://uclspp.github.io/PUBLG100/data/corruption.csv. Hint: the read.csv() function is needed for this.

Solution

# load csv data set

cor.data <- read.csv("http://uclspp.github.io/PUBLG100/data/corruption.csv")

Exercise 3

Inspect the data. Spending some time here will help you for the next tasks. Knowing and understanding your data will help you when running and interpreting models and you are less prone to making mistakes.

Solution

There are many different ways to get an overview over the data. The important thing is that you know the levels of measurement and that you are roughly familiar with the range of the variables.

summary(cor.data)

country country.code country.abbr ti.cpi

Albania : 1 Min. : 8.0 AGO : 1 Min. :1.200

Algeria : 1 1st Qu.:209.0 ALB : 1 1st Qu.:2.500

Angola : 1 Median :420.0 ARE : 1 Median :3.300

Argentina: 1 Mean :431.5 ARG : 1 Mean :4.051

Armenia : 1 3rd Qu.:658.0 ARM : 1 3rd Qu.:4.900

Australia: 1 Max. :894.0 AUS : 1 Max. :9.700

(Other) :164 (Other):164

gdp region

Min. : 520 Africa :51

1st Qu.: 1974 Americas:32

Median : 5280 Asia :48

Mean : 8950 Europe :39

3rd Qu.:10862

Max. :61190

Exercise 4

Run a regression on gdp. Use ti.cpi (corruption perceptions index, larger values mean less corruption) and region as independent variables. Print the model results to a world file called "model1.doc". Also print, your output to the screen.

Region is a categorical variable and R recognizes it as a factor variable. The variable has four categories corresponding to the four regions. When you run the model, the regions are included as binary variables (also sometimes called dummies) that take the values 0 or 1. For example, regionAmericas is 1 when the observation (the country) is from the Americas. Only three regions are included in the model, while the fourth is what we call the baseline or reference category. It is included in the intercept. Interpreting the intercept would mean, looking at an African country when ti.cpi is zero. If the estimate for the region dummy Europe is significant then that means that there is a difference in the dependent variable between European countries and the baseline category Africa.

Solution

# estimate linear multivariate regression model

m1 <- lm(gdp ~ ti.cpi + region, data = cor.data)

# print model output to word file

htmlreg(m1, file = "model1.doc")

The table was written to the file 'model1.doc'.

# print output to screen

screenreg(m1)

============================

Model 1

----------------------------

(Intercept) -6607.83 ***

(992.80)

ti.cpi 3437.55 ***

(221.40)

regionAmericas 104.63

(1243.02)

regionAsia 1036.41

(1103.24)

regionEurope 5758.61 ***

(1287.72)

----------------------------

R^2 0.72

Adj. R^2 0.71

Num. obs. 170

RMSE 5375.97

============================

*** p < 0.001, ** p < 0.01, * p < 0.05

Exercise 5

Does the inclusion of region improve model fit compared to a model without regions but with the corruption perceptions index? Hint: You need to compare two models.

Solution

To do this, we estimate a model with ti.cpi but without the regions. We then run an F-test comparing the the two models. Taking a look at the p-value reveals we can reject the null hypothesis that the reduction in the unexplained error is due to chance. Our model including regions is an improvement over the more general model.

# estimate linear model excluding regions

m.noregions <- lm(gdp ~ ti.cpi, data = cor.data)

# joint hypothesis testing

anova(m.noregions, m1)

Analysis of Variance Table

Model 1: gdp ~ ti.cpi

Model 2: gdp ~ ti.cpi + region

Res.Df RSS Df Sum of Sq F Pr(>F)

1 168 5504948435

2 165 4768671746 3 736276689 8.4919 2.802e-05 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

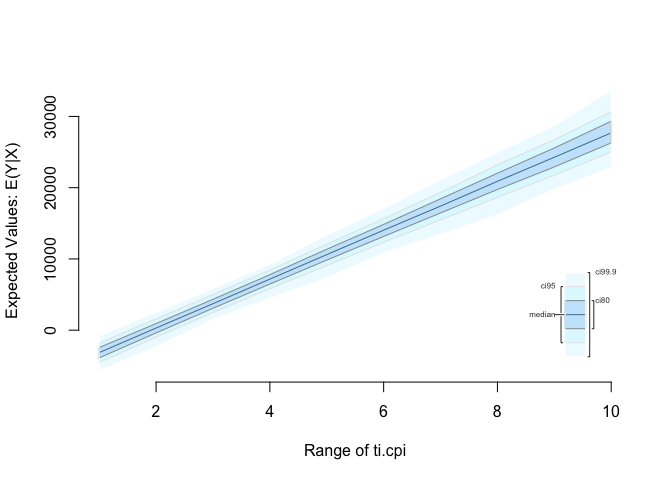

Exercise 6

Predict gdp by varying ti_cpi from lowest to highest using the model that includes region. Plot your results.

Solution

We do this using zelig(). First, we estimate a linear model. Then we check the range of ti.cpi which varies roughly from 1 to 10. Then we set our covariates. And vary ti.cpi from 1 to 10. Next, we simulate using our model and the covariates and finally plot our predictions.

# estimate the linar model including regions

linear.model <- zelig( gdp ~ ti.cpi + region, data = cor.data, model = "ls")

How to cite this model in Zelig:

Kosuke Imai, Gary King, and Olivia Lau. 2015.

"ls: Least Squares Regression for Continuous Dependent Variables"

in Kosuke Imai, Gary King, and Olivia Lau, "Zelig: Everyone's Statistical Software,"

http://gking.harvard.edu/zelig

# look at the ti.cpi variable to see the range

summary( cor.data$ti.cpi)

Min. 1st Qu. Median Mean 3rd Qu. Max.

1.200 2.500 3.300 4.051 4.900 9.700

# set the covariates

covariates <- setx( linear.model, ti.cpi = 1:10)

# simulate

predictions <- sim( linear.model, covariates)

# plot results

plot(predictions)

Exercise 7

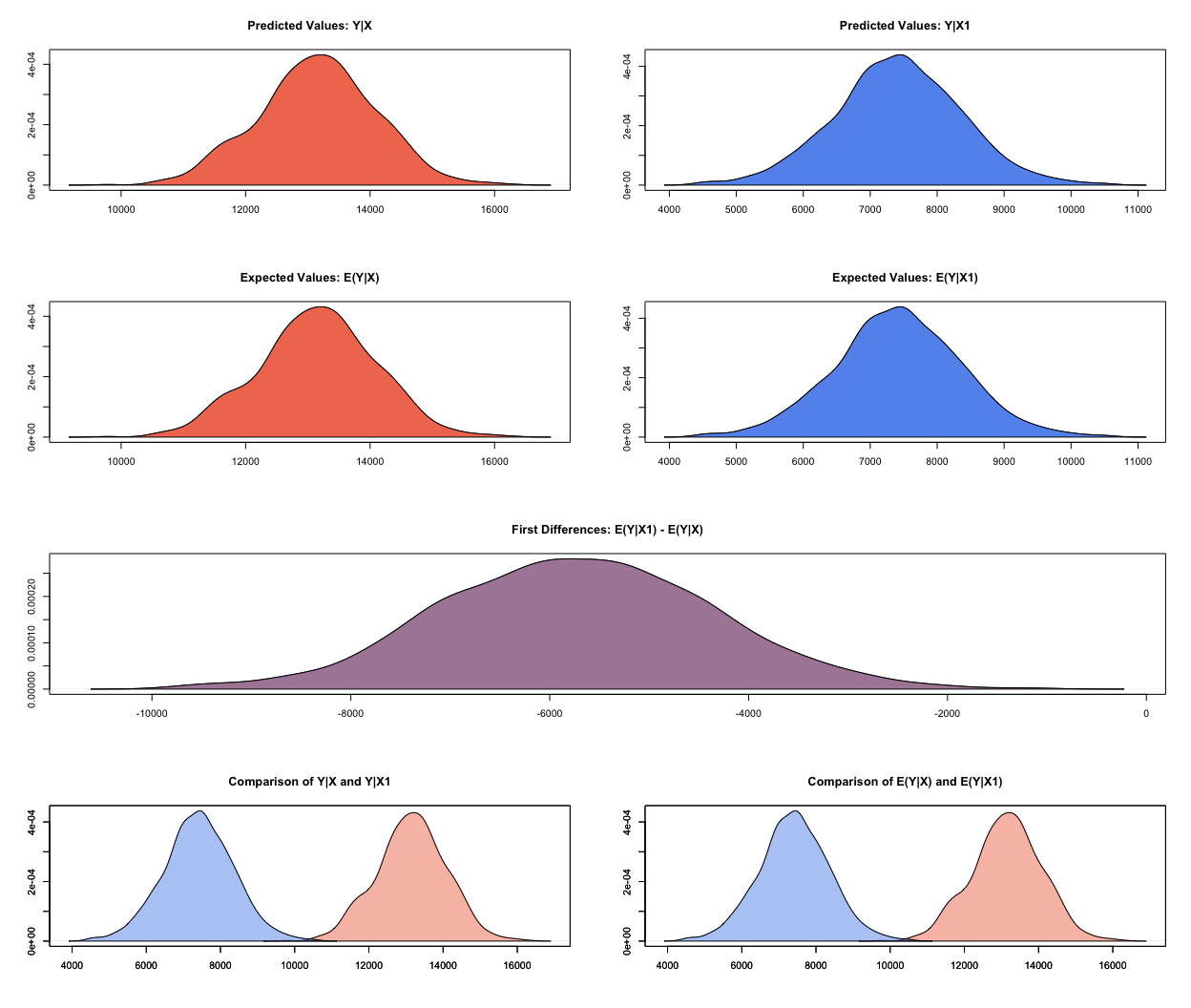

Is there a difference between Europe and the Americas? Hint: is the difference between the predicted values for the two groups significantly different from zero?

Solution

We use zelig just like in exercise 6 but this time we set two specific scenarios. The first is Europe, the second is the Americas. Because ti.cpi is interval scaled and we did not specify a value for it, Zelig automatically sets it to the mean. Once we simulated, we look at the first differences and can confirm that the difference in political stability between the two regions is indeed statistically different from zero.

# estimate the linear model including regions

linear.model <- zelig( gdp ~ ti.cpi + region, data = cor.data, model = "ls")

How to cite this model in Zelig:

Kosuke Imai, Gary King, and Olivia Lau. 2015.

"ls: Least Squares Regression for Continuous Dependent Variables"

in Kosuke Imai, Gary King, and Olivia Lau, "Zelig: Everyone's Statistical Software,"

http://gking.harvard.edu/zelig

# look at the labels of the factor variable regions

table(cor.data$region)

Africa Americas Asia Europe

51 32 48 39

# set the covariates

europa <- setx( linear.model, region = "Europe")

amerika <- setx( linear.model, region = "Americas")

# simulate

predictions <- sim( linear.model, x = europa, x1 = amerika)

# look at the first difference

summary(predictions)

Model: ls

Number of simulations: 1000

Values of X

(Intercept) ti.cpi regionAmericas regionAsia regionEurope

1 1 4.050588 0 0 1

attr(,"assign")

[1] 0 1 2 2 2

attr(,"contrasts")

attr(,"contrasts")$region

[1] "contr.treatment"

Values of X1

(Intercept) ti.cpi regionAmericas regionAsia regionEurope

1 1 4.050588 1 0 0

attr(,"assign")

[1] 0 1 2 2 2

attr(,"contrasts")

attr(,"contrasts")$region

[1] "contr.treatment"

Expected Values: E(Y|X)

mean sd 50% 2.5% 97.5%

1 13143.88 948.09 13148.46 11324.66 14897.34

Expected Values: E(Y|X1)

mean sd 50% 2.5% 97.5%

1 7411.753 952.028 7420.453 5523.18 9313.419

Predicted Values: Y|X

mean sd 50% 2.5% 97.5%

1 13143.88 948.09 13148.46 11324.66 14897.34

Predicted Values: Y|X1

mean sd 50% 2.5% 97.5%

1 7411.753 952.028 7420.453 5523.18 9313.419

First Differences: E(Y|X1) - E(Y|X)

mean sd 50% 2.5% 97.5%

1 -5732.129 1360.073 -5742.004 -8405.733 -3020.748

# you can do this visually, too

plot(predictions)