UCL Venture Insight Series: An Overview of Venture Capital as a Translational Funding Option

29 November 2021

This article provides a brief overview of the 3x 90-minute UCL Venture Insight sessions and material covered by the presentations from Simon Goldman (UCL Tech Fund), as well links to the full webinar recordings (open to UCL only).

In October 2021 the TRO hosted a three-seminar ‘Venture Insight’ series to help UCL researchers better understand Venture Capital (VC) as a funding option for commercialisation of academic research, highlighting considerations for researchers thinking of taking VC investment and improving chances of success.

Seminar 1 – What an earth is going on in a VCs mind?

“Venture investing is absolutely about people and understanding how people make decisions and, hopefully, pulling in the same direction to achieve global impact”. – Simon Goldman, UCL Tech Fund

This first session aimed to set the scene by covering what VCs do, how they think and what motivates them when it comes to funding projects, as well as the de-risking strategies that the UCL Tech Fund can help with to support a successful outcome.

The seminar highlights three major components of decision-making processes, highlighting how they apply in particular to university-focused VCs:

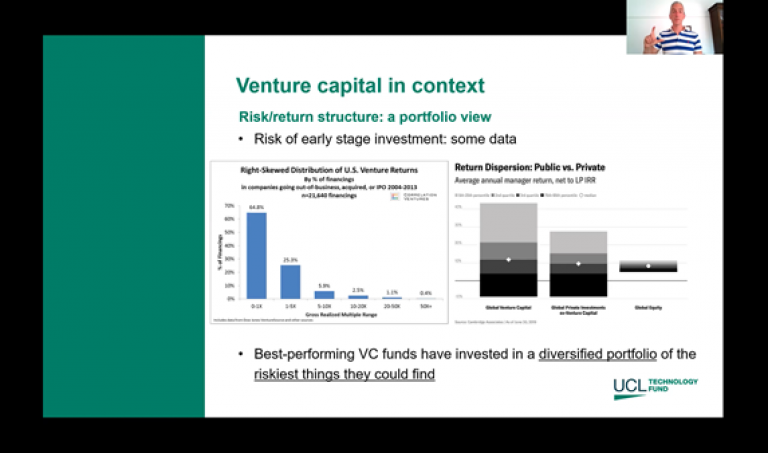

- Risk/Return Structure – what are the risks being taken? What are the potential returns? How do these relate to each other?

- Incentive Structure – What is motivating the person/people who are making the decisions?

- Time Horizon – Over what period of time will a decision have impact and lead to other decisions needing to be made?

To learn about how these factors feed into a VC’s desire to invest in a project or not, watch the first session:

UCL Venture Insight Seminar 1 recording – What an earth is going on in a VCs mind?

Seminar 2 - ‘Due diligence’ and ‘business planning’: a mirror image

The second seminar provides some more background on the process of due diligence from a VC perspective – how do you get them to say “yes”? This requires an understanding of the concept of fiduciary duty, because an institutional VC will be investing other people’s money – and so they need to demonstrate that they’ve completed a rigorous review of the potential risks and returns of any given program in order to get approval.

The session also covers the detailed process of due diligence and business planning (which are basically the same thing), including:

- “Why” is the proposed program important: Unmet Need/Commercial Opportunity

- “What” activities are proposed to be funded: Business Plan/Gantt

- “How” is the plan to be executed and a return generated: Teams/Risks/Returns

For more information and to explore these points in detail, watch the second seminar of this series in full:

UCL Venture Insight Seminar 2 recording – ‘Due diligence’ and ‘business planning’: a mirror image

Seminar 3 - I’m suspicious of your cap table: what is this sorcery?

The final UCL Venture Insight seminar highlighted the importance of finding an exit for any given investment in order to generate a return This includes two main routes for life-science intellectual property commercialisation:

- Is it a share of milestone/royalty venue on a license of the IP? And if so, then when is that likely to be received and how much will it be?

- Is it the sale of an equity stake? If so, then how is that stake going to be sold and when, and for how much?

If you would like to learn more about the most suitable exit strategy for your project, be sure to watch the final seminar of this series:

UCL Venture Insight Seminar 3 – I'm suspicious of your cap table: what is this sorcery?

If you’ve watched the whole series and would like to talk to Simon about the opportunities discussed, please reach out to him on s.goldman@ucl.ac.uk.

In addition, Pamela from the TRO would be happy to discuss translational funding options supported by her team and TIN opportunities: p.tranter@ucl.ac.uk. We also encourage you to sign up to the Therapeutic Innovation Networks (TINs) newsletter for internal and external funding opportunities.

As a reminder, please note that all webinar recordings are available to UCL only, you must use your UCL account details to sign in and view the webinars.

Close

Close