UCL HE-BCI return

12 January 2023

The Higher Education Business and Community Interaction (HE-BCI) is a statutory Higher Education Statistics Agency (HESA) return. Find out what you need to do for UCL's HE-BCI return.

The HE-BCI survey collects financial and output data related to knowledge exchange each academic year and has been running since 1999. It aims to capture knowledge exchange activity happening across the university and is the main vehicle for measuring the volume and direction of interactions between higher education providers in the UK and business and the wider community.

Why does HE-BCI matter?

HE-BCI figures are the base of the Knowledge Exchange Framework (KEF), which is published by UK Research and Innovation (UKRI). The KEF provides information on the knowledge exchange activities of higher education providers in England. HE-BCI figures are also used to calculate UCL’s Higher Education Innovation Funding (HEIF), which currently sits at £5.6m.

Most importantly, as a statutory return, HE-BCI may be subject to audit by the funding bodies. Therefore UCL must ensure that the return is completed uniformly and that we are confident of the total income returned.

What is required?

As part of UCL’s return for ‘Collaborative Research Income’, UCL must identify projects that have a source of public funding plus an additional source of funding that can be either in cash or in-kind.

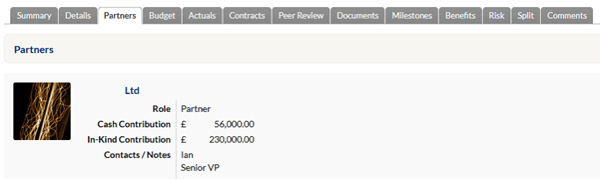

To ensure that your research team, Department and UCL receive full credit under this category, please identify partners, and any cash or in-kind contribution to the project by them in the Worktribe record.

It is important to obtain and upload to the Worktribe record formal documentation from the partner on cash and in-kind contributions so as to have an auditable trail.

Further information

HE-BCI is collated and managed by UCL Innovation & Enterprise. If you have any questions regarding the return please get in touch with Nicolas Ulloa Olguin at nicolas.ulloa-olguin@ucl.ac.uk.

Close

Close