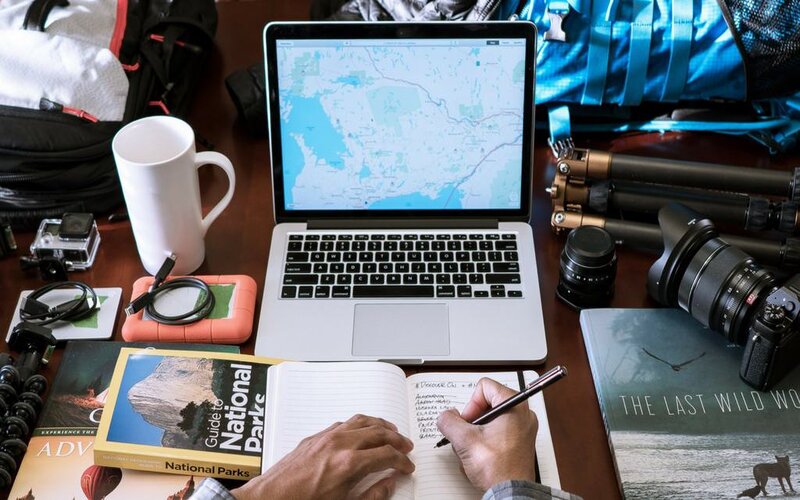

Go abroad

Go Abroad Week

Learn more about the international opportunities available to students.

Global Opportunities Email List

Sign up to our email list to stay updated throughout the year about international opportunities.

Global Assistance Programme

Free and confidential support is available anytime, any day whilst you're abroad.

Short-Term Mobility

Find out more about international short-term mobility options.

Semester/Full Year Study Abroad Options

Information about studying abroad as part of students' degree programmes.

Student experiences

Hear from UCL students around the globe and get a glimpse of what opportunities await.

Close

Close