Find out more about our exciting annual events programme and news from our student and staff community.

News

In a landmark summit held at the House of Parliament's Committee Room 12, key figures from the tech and finance sectors convened to discuss the burgeoning digital economy's trajectory in Britain. The session, titled "The digital economy is transforming Britain, but it comes with risks from AI and fraud. The regulators need to catch up, and it's our job to help them!" provided a critical platform for dialogue on the future of digital innovation and its regulation.

Prof. Francesca Medda underscored the crucial role of academic input in navigating the digital economy's complexities and emphasized the significance of nurturing financial talent and fostering academia-industry collaborations to ensure the sector's robust growth. Her perspective highlighted the need for an educational framework that adapts to the evolving demands of digital finance, preparing a workforce capable of driving innovation while safeguarding against the inherent risks of digitalization.

As IFT's winner, Francis also qualifies to participate in the annual WCIB Lombard Prize competition, a nationwide competition where he will compete against 21 other WCIB prize winners from other business schools. We wish him the best of luck!

Peter Zaffino, Chairman & CEO, AIG, said “We are very pleased that Paola is joining the AIG Board of Directors. Paola is an experienced financial services executive and independent director who brings deep international expertise in capital markets, global banking, and risk and international regulatory oversight.” Read the full press release here.

The MSc will equip students with the skills and tools required to grasp the underlying concepts and practical trade-offs involved in sustainable finance and impact and environmental investment and policy.

Applications open in January 2023. Find out more via the prospectus page here.

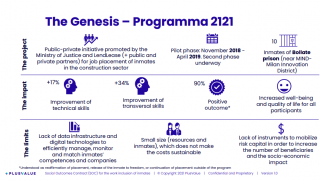

IFT's PhD researcher Filippo Addarii is pioneering a project to break the recidivism cycle in Italy. By increasing work inclusion of convicts, the project should reduce reincarceration rates and associated social costs. Read more here.

The VC Scholar programme is a 3-week event that provides MSc and PhD students the opportunity to delve deep into the financial technology sector and venture capital industry in Luxembourg and the European Union. We can't wait to hear more about what Pornpanit learns and brings back with her to implement in her studies!

Photo cred: The LHoFT/Middlegame Ventures

Her entry was also featured on UCL's Instagram here.

Read the full press release here via GlobalNewswire.

He joined Frederick Chu, Executive Director at Haitong International Asset Management, Pat Woo, Partner at KPMG China, and Kin Yu, Data Analytics Director at ESG IQ.

As a prize, Chloe was invited to join one of the WCIB's major City of London functions. Congratulations Chloe!

Paravani explains how writing a children’s book and teaching machine learning has helped her learn resilience and prevented her from becoming a ‘dinosaur.’

Close

Close