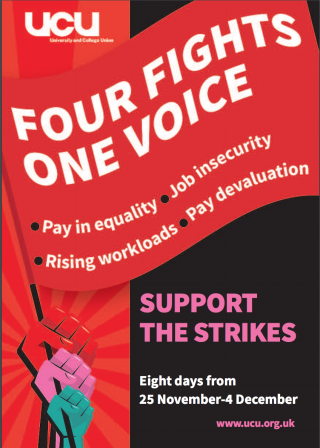

UCL UCU members will be taking strike action from Monday 25th November

UCU members backed strike action in two separate legal disputes, one on pensions and one on pay and working conditions. Overall, 79% of UCU members who voted backed strike action in the ballot over changes to pensions. In the ballot on pay, equality, casualisation and workloads, 74% of members polled backed strike action.

WHY HAS UCU CALLED FOR INDUSTRIAL ACTION?

EQUALITIES, PAY, WORKLOAD AND JOB SECURITY BALLOT

- 70% of researchers in the UK are on casual contracts. Over 100,000 teaching staff in universities are employed on casual contracts. According to UCU research, 73% of casualised staff say they do not have enough paid time to complete marking, 78% of casualised staff work more hours than they are paid for, and on average casualised staff do 45% of their work without pay. It is telling that the same research shows that 97% of casualised staff wish they were on a secure permanent contract. Lack of job security and / or a stable location has serious effects on a range of issues including physical and mental health. It impinges on our ability to secure a mortgage, have stable rental arrangements, maintain relationships with family and friends and to keep up activities outside work.

- University management have NOT addressed the declining value of members pay, which has fallen in real terms by 21% over the past decade. Given the high cost of living, many members are struggling financially.

- Coupled with these issues are the more widely-experienced concerns of excessive workload affecting physical and mental health and eating into personal time.

- Then there are the serious challenges posed by equalities barriers that adversely affect the pay and progression of our members.

- HESA data shows that the sector as a whole is running record surpluses in the past decade. As a proportion of total expenditure, spending on staff has fallen significantly – both as a proportion of total spend and as a proportion of income. More locally our income from teaching and from research have both increased.

- Affordability goes hand in hand with prioritisation. The data and our daily experiences on the ground show us that there is money in our university budgets that is prioritised for significant spending on marketing budgets, overseas campuses, shiny buildings, consultancy arrangements, complex financial arrangements and senior management remuneration.

- Our members are absolutely central to the varied and significant ways in which HE transforms the lives of our students, our institutions and our communities. Yet, we are treated as expendable resources whose skills and intellect should be maximally exploited while pay is minimised and conditions deteriorate.

- National agreement on all these issues is vital if we do not want employers to undercut each other with ever more precarious and / or discriminatory employment practices.

USS BALLOT

- Our call for strike action on USS is tied to our democratically agreed position of NO DEFICIT, NO DETRIMENT.

- USS has a very healthy £74bn (and increasing) fund. In 2017 it was reporting a £64bn fund.

- The scheme is cash-flow positive. In 2018-19, contributions in total were £2.2bn, and £2.0bn was paid out to pensioners. We do not draw upon the assets at all. According to the Joint Expert Panel’s (JEP) first report, the scheme is expected to be cash-flow positive for another 50 years.

- Members’ contributions have been forced up to 9.6% of salaries in October 2019 - a 20% increase from the 8% we paid this time last year. The employers have increased their contributions by 17.2% to 21.1% of salaries (up from 18%).

- The way the scheme is valued is by imagining that the scheme will be 'de-risked' in the future. 'De-risking' means that the assets currently invested in stocks and shares (that have caused the scheme to grow by £10bn) are sold off and placed in low interest bearing government bonds and gilts. Since these pay very low rates of interest, below the rate of inflation, inflation will then devalue the assets over the years, creating a deficit.

- Fortunately this scenario is entirely fictitious. If the scheme had been 'de-risked' it would not have grown by £10bn in 2 years. But if it is fictitious, why is this model being used to value the scheme? The Joint Expert Panel said this was ridiculous, and rightly so.

- The additional contributions planned will add less than £1bn to the fund over the next two years, less than 10% of the asset growth over the last two. The additional contributions are demanded because of a model that has not been implemented, and make no mathematical sense when set against the reality!

- The additional contributions are, however, a huge price hike for employees and employers. UCU argues that this unnecessary price rise is designed for one reason only: to price members and employers out, and promote the idea that a 100% "Defined Contribution" stocks-and-shares personal gamble scheme will be the only viable option after the next valuation.

- Members showed good faith by halting a very successful strike last year. But we are appalled that despite their supposed commitment to the Joint Expert Panel, employers have dragged their feet and not taken credible actions (and we have waited a year now) to join us in ensuring that USS operationalises the JEP’s first set of recommendations, as a starting point for reform.

- Employers previously benefitted from a decade of underpayments. Now they are paying more. But they are refusing to join UCU in demanding the scheme is valued properly, in terms of its actual assets, instead of using a fictitious 'de-risking' scenario. They are creating a USS crisis entirely unnecessarily, and they are even paying for it.

- By failing to use their powers in the governance of USS, our employers have also reinforced our concerns regarding their lack of commitment to substantive reform that would bring costs down for everyone (members and institutions) while retaining current benefits.

- Remember, UCU’s position has been vindicated by the first report of the JEP and by independent actuarial reports.

- Meanwhile, employers, their lobbyists and paid experts, continue to distort the narrative on USS, by reiterating their commitment to the faulty decisions made by the USS Board, and by sowing confusion and mistrust through their communications.

- While we have serious concerns about the governance of USS, we recognise that employers are very much front and centre in our concerns because of their overt and covert complicity in the poor governance of USS and the undermining of our pension.

- Employers pay lip-service to retaining DB but their actions (and inaction) are making the cost of pensions unsustainable for themselves and us, thus paving an easy path to reducing benefits or closing DB.

- Further increases to our contributions are imminent, and unless we take a stand now, will continue their upward trajectory in the next valuation cycle.

Close

Close