Monitoring the Monitor: Oligarch Networks and OrganizationalTransparency in Russian Listed Firms

27 January 2016, 12:45 pm–2:00 pm

Event Information

Open to

- All

Organiser

-

UCL SSEES

Location

-

Room 431, UCL SSEES, 16 Taviton Street, London, WC1H 0BW

Can ownership networks and corporate governance practices alleviate institutional voids in an emerging economy? Anna Grosman (University of Aston) explores this question as part of the Centre for Comparative Studies of Emerging Economies seminar series.

This paper, co-authored with Aija Leiponen, examines different sources of organizational power and highlight the conditions under which ownership networks provide resources for firm growth through investments. Using Russian panel data, we find that when public institutions do not support information disclosure and contract enforcement, controlling owners may compensate by setting up networks that facilitate the exchange of resources and alignment of interests. When power asymmetries arising from controlling ownership are pronounced, firms can reduce information asymmetries among shareholders by committing to transparency and disclosure practices, or multiple major shareholders can discipline one another. Agency costs can thus be mitigated by “monitoring the monitor.”

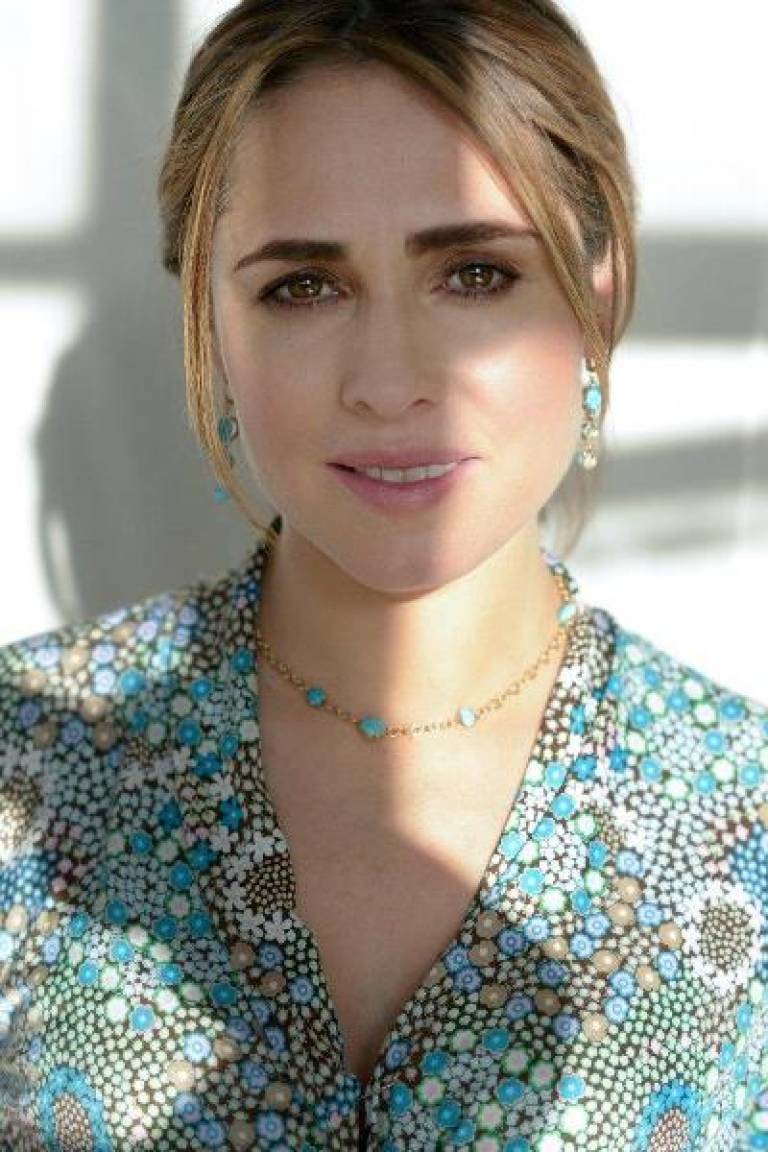

Biography

Anna Grosman joined the Economics, Finance and Entrepreneurship Group at Aston Business School in September 2013, upon the completion of her PhD at Imperial College London. Prior to her PhD, Anna worked for Georgia-Pacific/Koch Industries (revenues of US$98bn, second largest private US firm) as a Director of Strategy, Corporate Development and M&A in the international division for four years. Prior to that, she worked for over six years in investment banking and corporate finance for CIBC World Markets, Citigroup and Close Brothers.

Anna's research examines inter- and intra-firm corporate governance processes, and in particular, how institutional environments, ownership networks and structures, board structures, firm transparency, executive compensation and social capital influence a firm’s strategic decisions and outcomes. In order to do so, she draws upon a variety of literatures to uncover how social evaluations (e.g., social status, network ties, and informal activities), long term incentives, and expectations of managers and owners may influence investment decisions and firm performance.

Anna is also interested in research at the intersection of governance and entrepreneurship, and in particular in entrepreneurs’ behaviour and governance of crowd-funded firms and platforms.

Close

Close