Budgeting as a student in London

For many students, leaving home for the first time to go and study represents their initial opportunity to manage their own household finances and living expenses. Generally, students in the UK are known for living frugally but the rising cost of living in London, and the effects of the Covid-19 pandemic, means that budgeting and penny pinching are critically important.

Why Budget?

Whether you rely on a maintenance loan, bursaries, parental support, part-time work, universal credit or any combination of these, a budget is essential. At its best, a budget can put you in a great position to save for the summer holidays. However, more critically, a budget will help you to avoid falling into a distressing financial situation. For example, the government’s money advice service states that by starting a budget you are:

- Less likely to end up in debt.

- More likely to have a good credit rating.

- More likely to be accepted for a mortgage or loan.

- More able to make savings.

Ensuring your money stretches to the month’s end is often an uphill battle but, making even a rudimentary budget can help ease your financial stress, helping you to focus on your studies and to enjoy your free-time.

Easier Than You Think

It is completely acceptable to not be an expert in budgeting and financial planning. This is especially true when you consider the absence of meaningful financial instruction on many national school curriculums.

Despite this, a budget does not have to be difficult to make and is only as strict and prescriptive as you make it. A basic budget can be made in a few simple steps, and even if it is not strictly adhered to, it represents a financial overview to refer to when necessary. While some extol the virtues of hand-written budgeting methods such as the Japanese Kakeibo method, the most accessible and flexible way to create a budget is to make a simple spreadsheet. You can download a free copy of Microsoft Excel as a part of UCL’s student provision of Microsoft 365 or if you prefer you can create a Google Sheets document. After doing this you can then build a basic budget by following these steps:

- List your yearly income in one column. (Including your maintenance loans, salary, parental support money, and bursary money).

- To get your monthly income, divide the total sum of your income by twelve.

- List your monthly fixed costs in a neighbouring column. (Including university halls fees, rent, your gas, electricity, water, phone, and internet bills).

- Add these costs together to receive your overall monthly fixed costs.

- After subtracting your monthly fixed costs from your monthly income, you will find out how much money you have leftover to spend each month.

- Now decide how much you have to spend on food, leisure, course expenses and unforeseen costs every month.

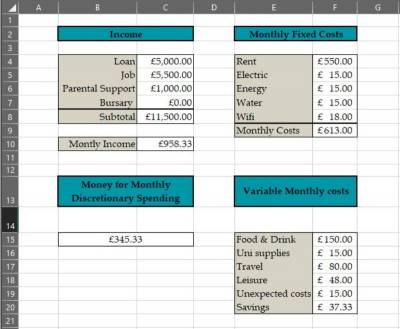

An example of a basic budget

Saving on Food Costs

There are a few simple things to keep in mind when budgeting for food.

- Purchase your basic food from lower-cost supermarkets when possible (these include Aldi, Lidl but also some markets stalls can yield discounts).

- Don’t shy away from buying cupboard ingredients from more expensive supermarkets and specialist food shops. If they help encourage and help you to cook and save money, they may be a good investment.

- Weekly food plans help you to make cheaper meals and to not waste any food.

Saving on University Expenses

Student maintenance loans do not cover all your university expenses. You must buy things such as stationery to help ensure your success.

- Many essential computer programs can be downloaded free through UCL’s software provision. See the UCL Software Database.

- To find discounts on personal computers you can buy them directly through outlet websites, and refurbished technology retailers. Student discounts will also help bring down the cost.

- Stationary can be bought in bulk online and visiting craft and hobby shops may provide a cheaper alternative for buying basic drawing materials. If you do need to purchase specialist art supplies, many art shops supply customer discounts.

- The Bartlett also promotes the use of waste and recycled materials for making models wherever possible.

- The first port of call for finding course books and research materials should be UCL’s Library Services or Senate House and the British Library. However, if you need to buy books, always look at eBay and second-hand book platforms like World of Books.

Helpful Websites

There are many websites to help you budget.

- Websites like trolley.co.uk can help you find the cheapest deal on food shops.

- Comparison sites like uswitch allow you to save money on bills.

- The Money Advice Service has an interactive budget planner and advice.

If You Need Help

Sometimes money problems can mount up despite your best efforts. If they do, please contact UCL’s Financial Support team. This service provides: financial assistance funds, emergency loans, and student funding advisers to help you.

About the author

Harry is a student on the MA Architectural History course at the Bartlett School of Architecture. He enrolled at UCL after completing an undergraduate degree in History at the University of Reading. As a proud west-country-man Harry enjoys exploring local history and the built environment through walking and photography. This has led him to write dissertations on John Nash’s Blaise Hamlet and the Great Western Railway’s Swindon Railway Village.

Close

Close